Indiana outlines the rules for its transfer on death deed in IC 32-17-14 — the “Transfer on Death Property Act.” The act, which became effective on July 1, 2009, gives owners/grantors of real estate in Indiana the ability to initiate, but not complete, the transfer process to a designated beneficiary while retaining absolute control in the property.

Image 341 of Dun and Bradstreet Reference Book: March, 1920; Vol. 208, part 1 | Library of Congress

Oct 24, 2023A Standard Document creating a Transfer on Death Deed (TOD deed) under Indiana law. It allows an owner (grantor) of real property to execute and record a deed that names the grantor or another (third) party as the named Owner of the real property until the named Owner’s death and also designates one or more beneficiaries to receive ownership of the real property on the named Owner’s death

Source Image: blog.elink.io

Download Image

Avoid probate – The limit for “small estates” (where no probate is required) in Indiana is currently $50,000. For most families, the home makes up the bulk of their assets. Using a transfer on death deed effectively makes the property a non-probate asset, which could potentially lower your estate value under the $50,000 limit.

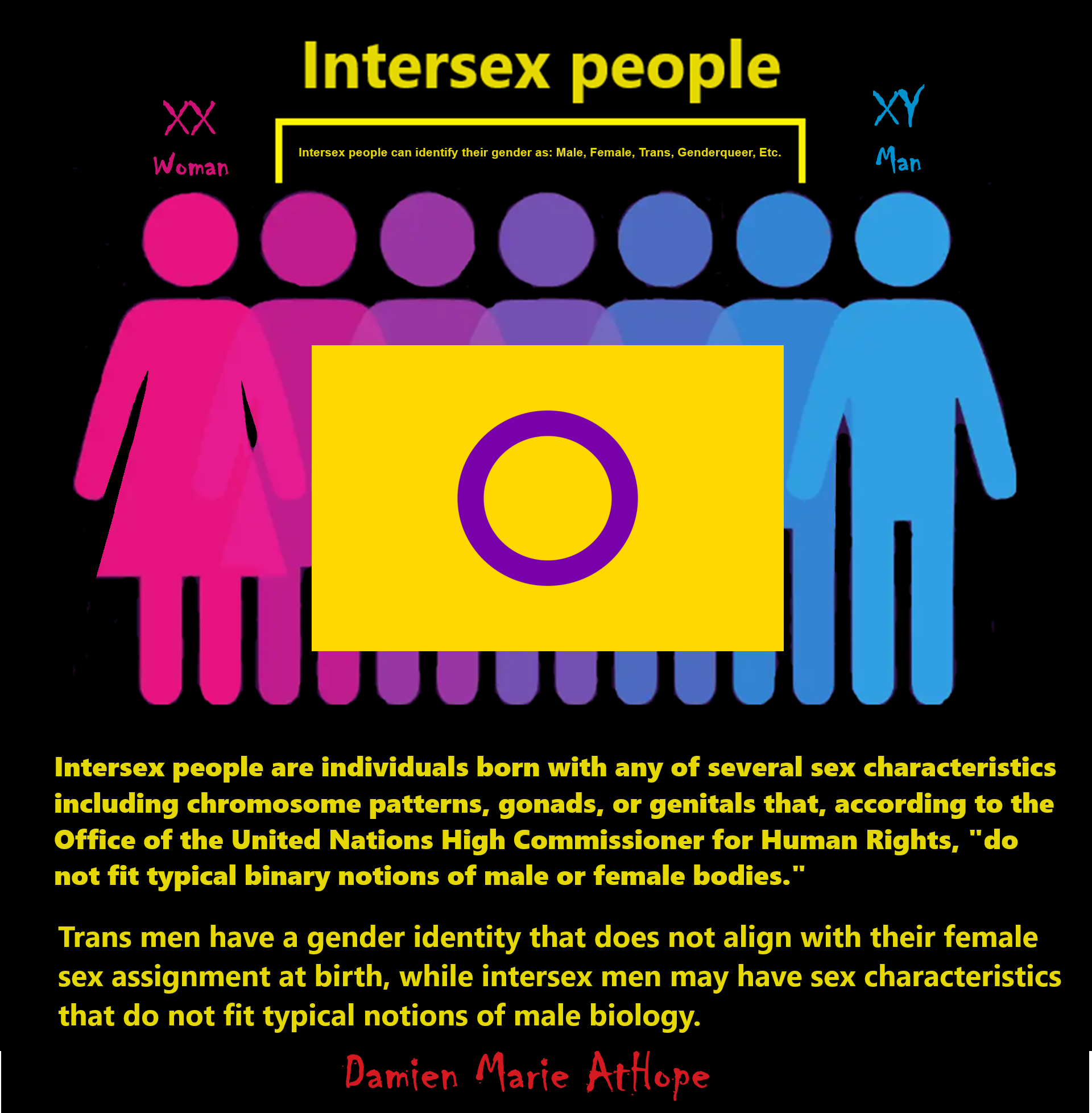

Source Image: damienmarieathope.com

Download Image

Indianapolis Monthly – June 2023 Edition by Indianapolis Monthly – Issuu Mar 4, 2024An Indiana transfer on death deed is an estate planning tool that allows a property owner to designate who will receive their property in the event of their death.If properly executed, the deed will allow the beneficiary of the property to avoid a potentially long and arduous probate process. The deed will have no effect on the owner’s property rights while they are alive.

Source Image: deeds.com

Download Image

Transfer On Death Deed Indiana Indianapolis Bar Association Form

Mar 4, 2024An Indiana transfer on death deed is an estate planning tool that allows a property owner to designate who will receive their property in the event of their death.If properly executed, the deed will allow the beneficiary of the property to avoid a potentially long and arduous probate process. The deed will have no effect on the owner’s property rights while they are alive. A transfer on death (TOD) deed is like a regular deed you might use to transfer your Indiana real estate, but with a crucial difference: It doesn’t take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it (your “beneficiary”), without the need for probate court proceedings. (Ind.

Indiana Transfer on Death Deed Forms | Deeds.com

Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 — the “Transfer on Death Property Act.” Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner’s death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The Remembering Tim Baldwin, a remarkable educator, colleague and friend to many – Kelley School of Business

Source Image: blog.kelley.iu.edu

Download Image

Transfer on death property act (TOD) : current state of the law and practical application Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 — the “Transfer on Death Property Act.” Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner’s death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The

Source Image: scholarship.law.nd.edu

Download Image

Image 341 of Dun and Bradstreet Reference Book: March, 1920; Vol. 208, part 1 | Library of Congress Indiana outlines the rules for its transfer on death deed in IC 32-17-14 — the “Transfer on Death Property Act.” The act, which became effective on July 1, 2009, gives owners/grantors of real estate in Indiana the ability to initiate, but not complete, the transfer process to a designated beneficiary while retaining absolute control in the property.

Source Image: loc.gov

Download Image

Indianapolis Monthly – June 2023 Edition by Indianapolis Monthly – Issuu Avoid probate – The limit for “small estates” (where no probate is required) in Indiana is currently $50,000. For most families, the home makes up the bulk of their assets. Using a transfer on death deed effectively makes the property a non-probate asset, which could potentially lower your estate value under the $50,000 limit.

Source Image: issuu.com

Download Image

Transfer on death deed wisconsin: Fill out & sign online | DocHub Apr 13, 2023Get a Customized Indiana Deed Today. An Indiana TOD deed form allows Indiana property owners to achieve two goals. It allows the owner to avoid probate at death. Upon the owner’s death, the property passes automatically to the beneficiaries named in the deed, without the need for Indiana probate. It allows the owner to retain control during life.

Source Image: dochub.com

Download Image

J. Imaging | Free Full-Text | Multiverse: Multilingual Evidence for Fake News Detection Mar 4, 2024An Indiana transfer on death deed is an estate planning tool that allows a property owner to designate who will receive their property in the event of their death.If properly executed, the deed will allow the beneficiary of the property to avoid a potentially long and arduous probate process. The deed will have no effect on the owner’s property rights while they are alive.

Source Image: mdpi.com

Download Image

PDF) The Puzzle of (Un)Countability in English. A Study in Cognitive Grammar. A transfer on death (TOD) deed is like a regular deed you might use to transfer your Indiana real estate, but with a crucial difference: It doesn’t take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it (your “beneficiary”), without the need for probate court proceedings. (Ind.

Source Image: researchgate.net

Download Image

Transfer on death property act (TOD) : current state of the law and practical application

PDF) The Puzzle of (Un)Countability in English. A Study in Cognitive Grammar. Oct 24, 2023A Standard Document creating a Transfer on Death Deed (TOD deed) under Indiana law. It allows an owner (grantor) of real property to execute and record a deed that names the grantor or another (third) party as the named Owner of the real property until the named Owner’s death and also designates one or more beneficiaries to receive ownership of the real property on the named Owner’s death

Indianapolis Monthly – June 2023 Edition by Indianapolis Monthly – Issuu J. Imaging | Free Full-Text | Multiverse: Multilingual Evidence for Fake News Detection Apr 13, 2023Get a Customized Indiana Deed Today. An Indiana TOD deed form allows Indiana property owners to achieve two goals. It allows the owner to avoid probate at death. Upon the owner’s death, the property passes automatically to the beneficiaries named in the deed, without the need for Indiana probate. It allows the owner to retain control during life.